snohomish property tax rate

Snohomish WA 98291-1589 Utility Payments PO. If you have questions you can reach out to our staff via phone email and through regular mail as well as visit our customer service center on the 1st floor of the Administration East Building on.

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

. The total sales tax rate in any given location can be broken down into state county city and special district rates. The minimum combined 2022 sales tax rate for Snohomish Washington is 93. Property Tax Exemptions Email the Property Tax Exemptions Division 3000 Rockefeller Ave.

Snohomish County Government 3000 Rockefeller Avenue Everett WA. Local City County Sales and Use Tax. Please call 425-388-3606 if you would like to make payments on your.

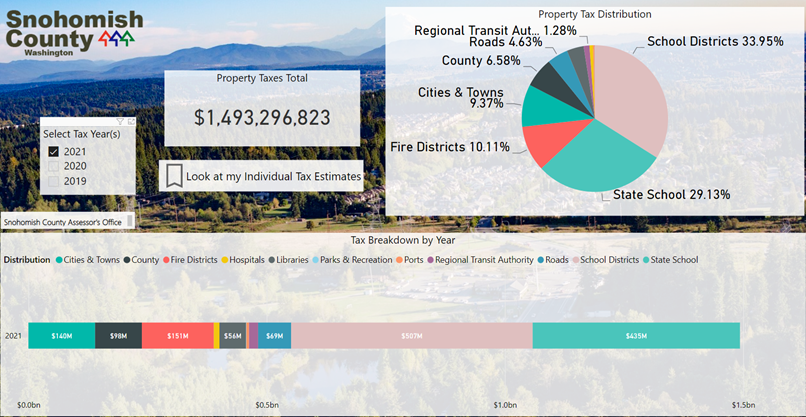

The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property. The median property tax. The following chart shows the average 2018 residence value in Snohomish County and the effect of taxes if the property stays the same or increases in 2019 using the state.

Download all Washington sales tax rates by zip code. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. How was your experience with papergov.

Vehicle Rentals less than 30 days Effective Dates. Explore important tax information of Snohomish. 2022 taxes are available to view or pay online here.

In case you missed it the link opens in a new tab of your browser. The Snohomish County Unincorp. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Snohomish County Tax Appraisers office.

The median property tax also known as real estate tax in Snohomish County is 300900 per year. MS 510 Everett WA 98201-4046 Ph. In our oversight role we conduct reviews of county processes and.

Property taxes have increased in recent. An additional 8 shall be assessed on the total amount of tax delinquent on. The minimum combined 2022 sales tax rate for Snohomish Washington is 93.

Non-rta Washington sales tax is 890 consisting of 650 Washington state sales tax and. A penalty of 3 shall be assessed on the amount of tax delinquent on June 1 of the year in which the tax is due. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Washington has a 65 sales tax and Snohomish County collects an. The countys average effective tax rate is 119. Levy Division Email the Levy Division 3000 Rockefeller Ave.

The Department of Revenue oversees the administration of property taxes at state and local levels. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The first half 2022 property taxes were due April 30th 2022.

The Washington sales tax rate is currently 65. Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office. It could have been better.

The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions. When summed up the property tax burden all owners shoulder is created. State Sales and Use Tax.

The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate. In this mainly budgetary function county and local public leaders estimate annual spending. Box 1589 Snohomish WA 98291-1589.

The Snohomish Washington sales tax is 910 consisting of 650 Washington state sales tax and 260 Snohomish local sales taxesThe local sales tax consists of a 260 city sales tax. First half tax payments made after that date will need to include any interest or. State Laws Revised Code of Washington RCW Pertaining to Property Taxes.

This is the total of state county and city sales tax rates.

News Flash Snohomish County Wa Civicengage

Graduated Real Estate Tax Reet For Snohomish County

2022 Best Places To Live In Snohomish County Wa Niche

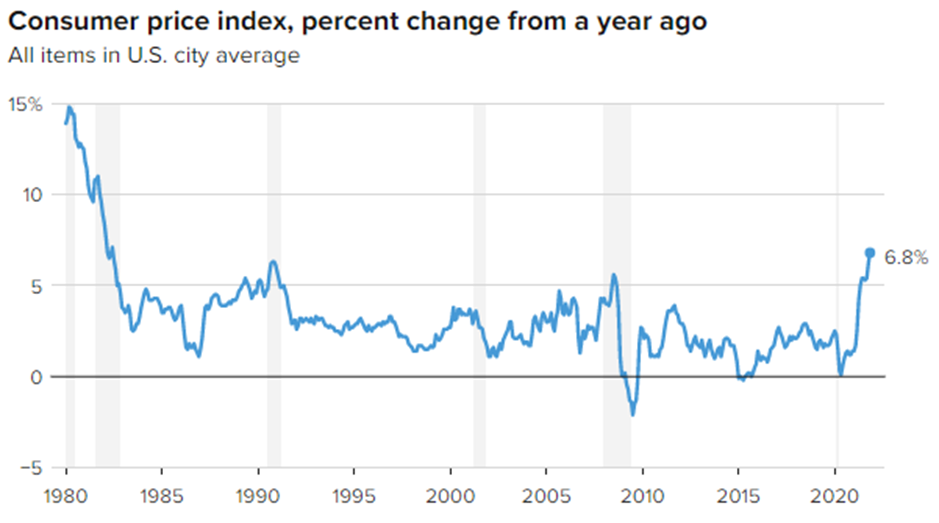

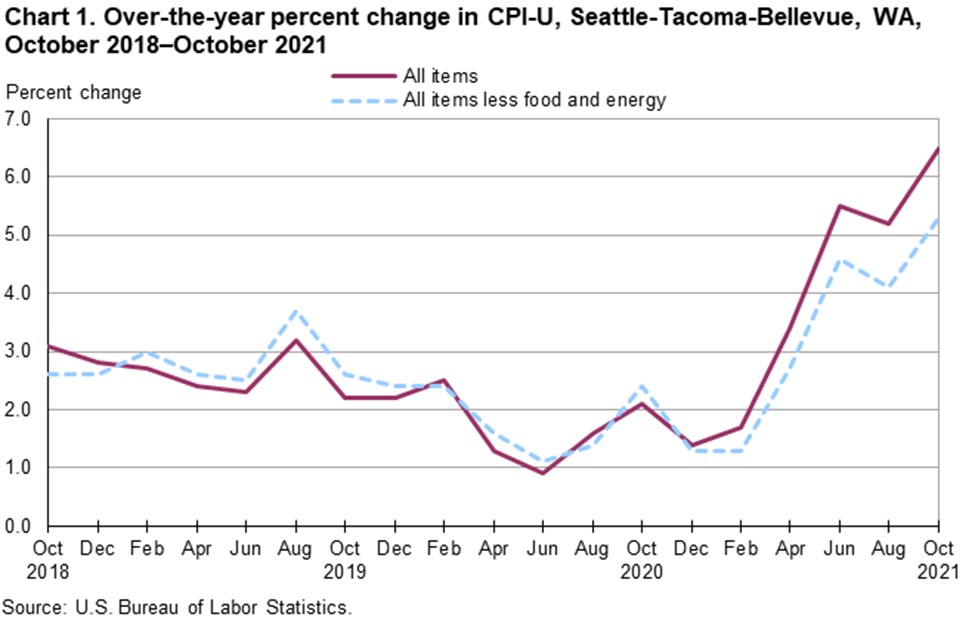

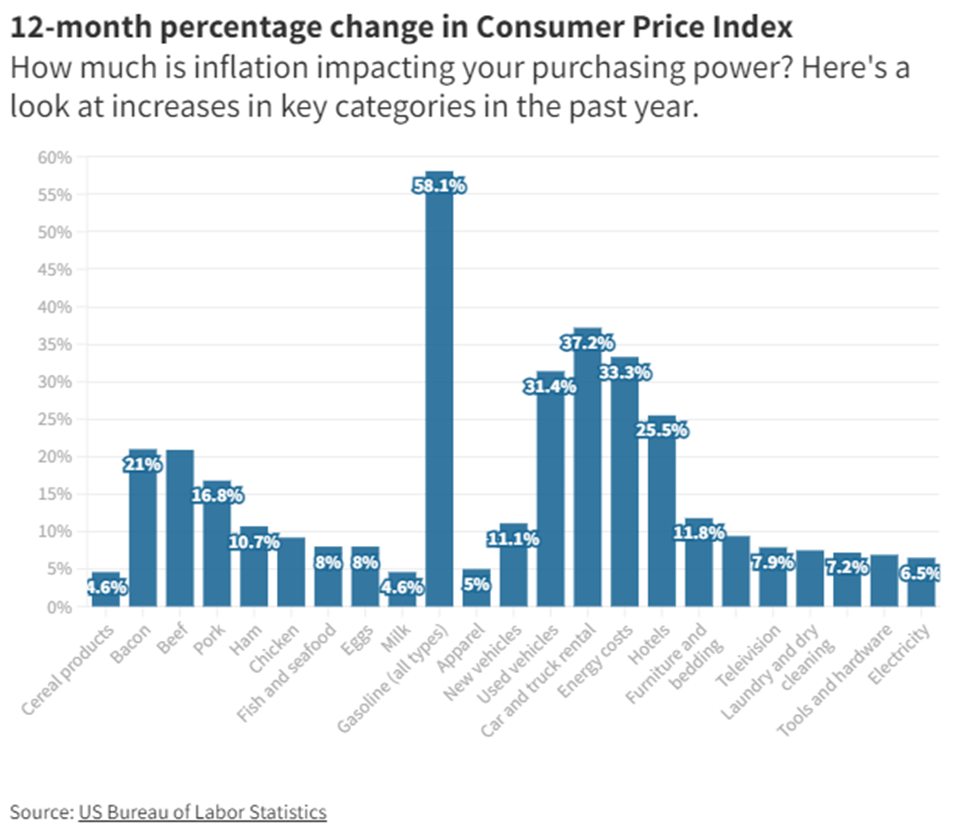

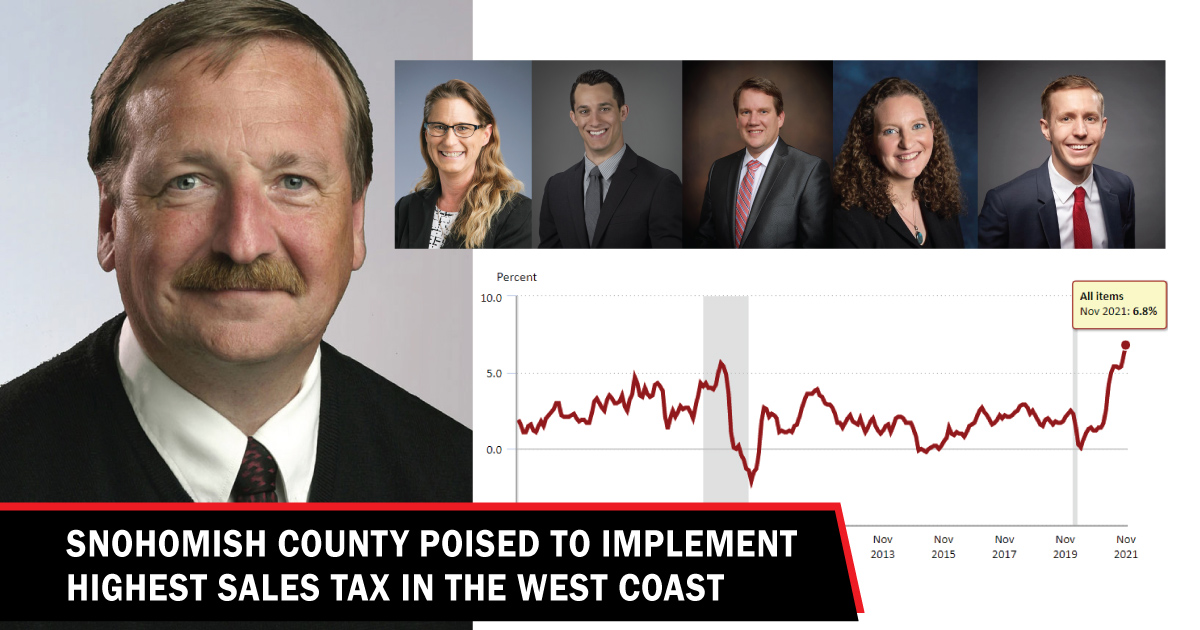

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Pin By The Platz Group On Homes For Sale In Snohomish County Marble Tile Floor Corner Fireplace Outdoor Decor

How To Read Your Property Tax Statement Snohomish County Wa Official Website

What Snohomish County Would Pay And What St3 Would Deliver Heraldnet Com

News Flash Snohomish County Wa Civicengage

Fireworks Ban Sought For South Snohomish County Heraldnet Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

How To Read Your Property Tax Statement Snohomish County Wa Official Website